What do I pay VAT on?

Self-build projects

On self-build projects you do not pay VAT on the construction costs but you will always pay VAT on consultants fees.

You can apply for a VAT refund on building materials and services if you’re:

- building a new home

- converting a property into a home

- building a non-profit communal residence – eg a hospice

- building a property for a charity

The building work and materials have to qualify and you must apply to HM Revenue and Customs (HMRC) within 3 months of completing the work.

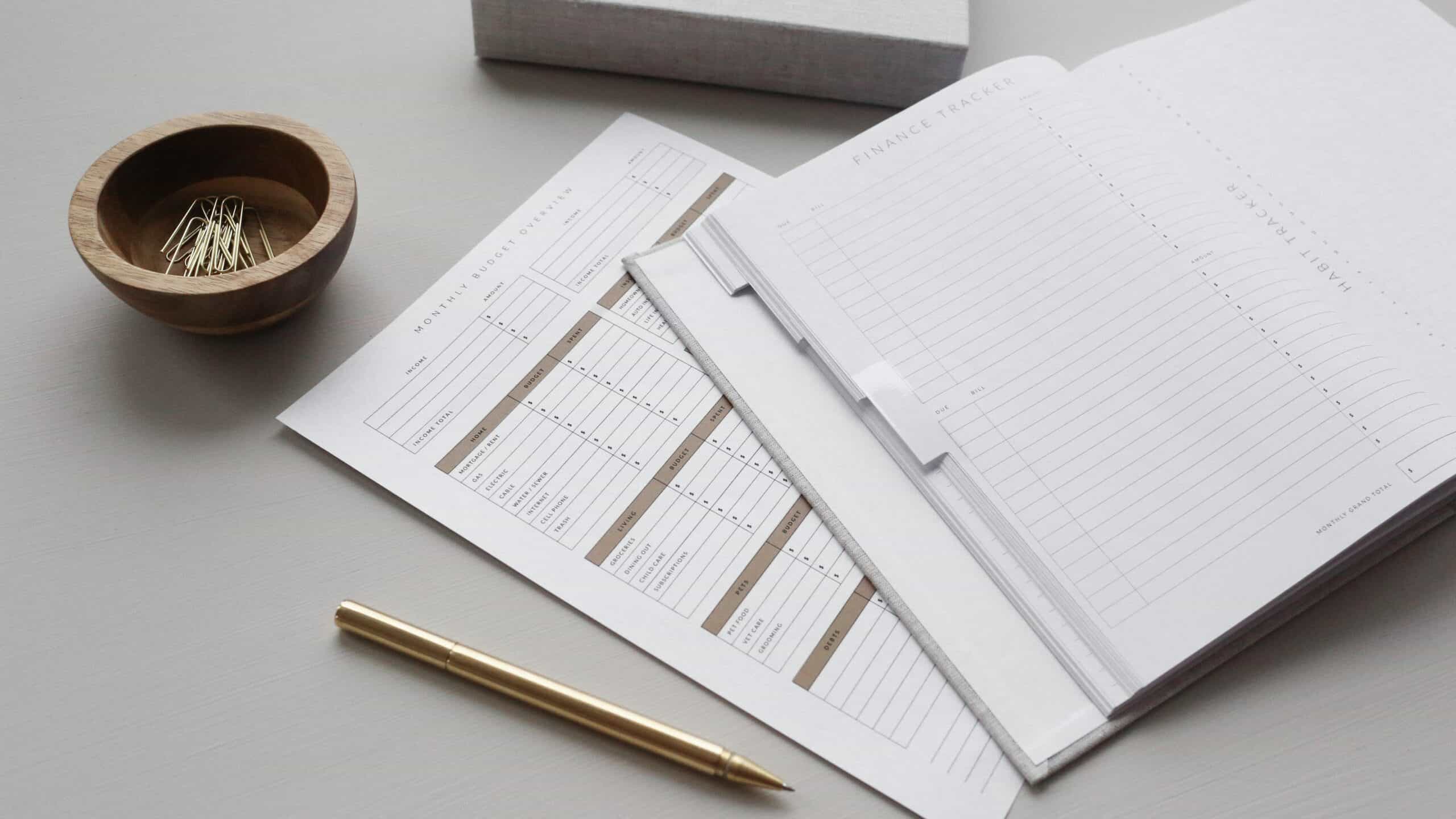

Renovation projects

VAT is applicable to all consultants.

If you carry out work to an existing building you will normally have to pay VAT at the standard rate. You may be able to pay VAT at the reduced rate of 5% if you’re renovating or altering either:

- an eligible dwelling that has not been lived in during the 2 years immediately before your work starts (although there’s an exception explained at paragraph 8.3.4)

- premises intended for use solely for a ‘relevant residential purpose’ (see paragraph 14.6) that have not been lived in during the 2 years immediately before you start your work